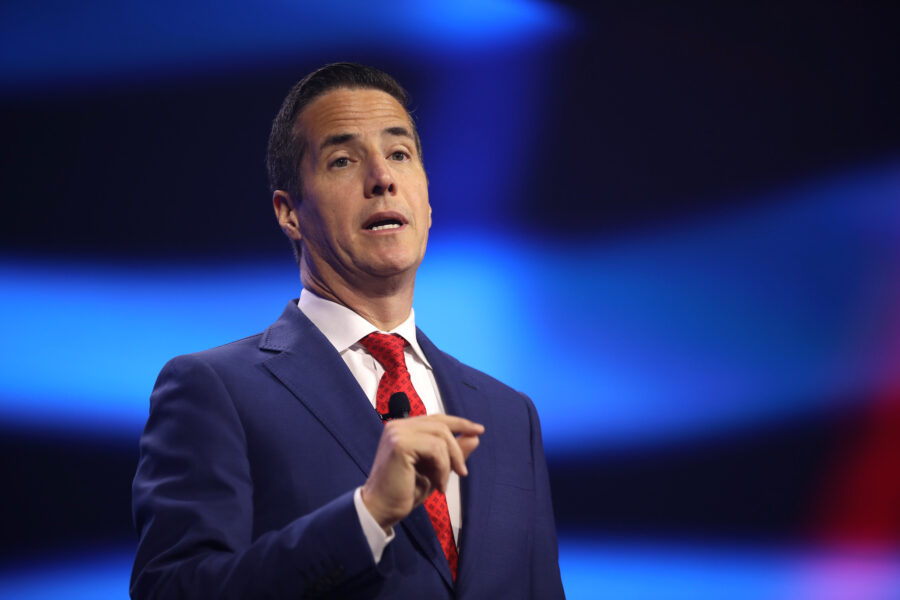

U.S. Senate candidate Bernie Moreno has endorsed the extension of the Tax Cuts and Jobs Act, a move that critics argue favors wealthy Americans and large corporations at the expense of ordinary taxpayers.

According to a recent report by the American Journal News, Moreno, whose net worth is estimated at $105.7 million, supports extending a tax plan that “primarily benefits wealthy Americans like himself.” The report highlighted Moreno’s consistent advocacy for making these tax cuts permanent.

The Tax Cuts and Jobs Act, enacted in December 2017 under former President Donald Trump, reduced tax rates for high-income individuals and corporations. These cuts are set to expire in 2025 unless Congress acts to renew them, making their future uncertain depending on the political landscape after the upcoming elections.

Moreno, a successful businessman with a chain of car dealerships, secured the Republican nomination in March to challenge incumbent Democratic Sen. Sherrod Brown. In the June 25 interview on conservative pundit Monica Crowley’s podcast, Moreno reiterated his support for extending the Trump tax cuts, responding “Of course” when asked if he would back their continuation.

The American Journal News also reported that this was not the first time Moreno expressed support for the tax cuts. In a December 2023 interview on the Bruce Hooley Show, he emphasized the need to make the Trump tax cuts permanent as a strategy to reduce the national debt and eliminate wasteful federal spending.

“The reality is we have to make the Trump tax cuts permanent in 2025,” Moreno stated in that interview. He made similar remarks at a Republican event in Highland Heights, Ohio, in September 2023, where he warned that the tax cuts would expire if Democrats remained in power.

However, economic experts and watchdogs challenge Moreno’s assertion that extending the Tax Cuts and Jobs Act would help reduce the national debt. The nonpartisan Committee for a Responsible Federal Budget reported in January that the law has already added $1.9 trillion to the national debt. Additionally, the Congressional Budget Office projected in May that extending the law could increase the deficit by another $4.6 trillion over the next decade.

Sen. Sherrod Brown, Moreno’s Democratic opponent, has criticized the tax cuts, arguing that they disproportionately benefit the wealthy and large corporations. Brown, who opposed the Tax Cuts and Jobs Act from the outset, has called for scaling back the law, asserting that it fails to support working families in Ohio.

As the 2024 Senate race in Ohio heats up, Moreno’s position on tax policy is expected to be a focal point of the campaign. The Cook Political Report has classified the race as a “toss-up,” indicating a highly competitive contest.

A request for comment from Moreno’s campaign was not immediately returned.